Get the free dock receipt template form

Show details

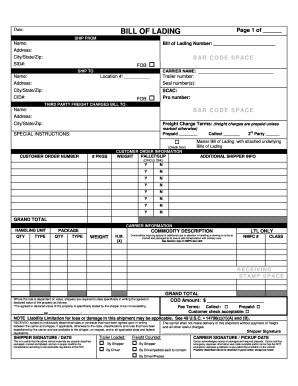

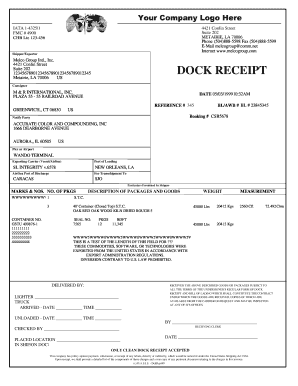

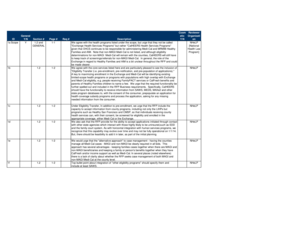

DOCK RECEIPT SHIPPER / EXPORTER BOOKING NUMBER EXPORT CARRIER TRUCKING COMPANY FORWARDING AGENT EXPORT INSTRUCTIONS DOMESTIC ROUTING/EXPORT INSTRUCTIONS PICK UP DATE PICK UP TERMINAL CUT OFF DATE RETURN TERMINAL OCEAN VESSEL VOYAGE NO. PORT OF LOADING PORT OF DISCHARGE PLACE OF DELIVERY LOADING PIER / TERMINAL TYPE OF MOVE CONTAINERIZED VESSEL ONLY MARKS NUMBER NUMBER PKGS YES DESCRIPTION OF COMMODITIES IN SCHEDULE B DETAIL DELIVERED BY LIGHTER TRUCK ARRIVED DATE TIME UNLOADED DATE TIME...

pdfFiller is not affiliated with any government organization

Get, Create, Make and Sign

Edit your dock receipt template form form online

Type text, complete fillable fields, insert images, highlight or blackout data for discretion, add comments, and more.

Add your legally-binding signature

Draw or type your signature, upload a signature image, or capture it with your digital camera.

Share your form instantly

Email, fax, or share your dock receipt template form form via URL. You can also download, print, or export forms to your preferred cloud storage service.

Editing dock receipt template online

To use the professional PDF editor, follow these steps below:

1

Sign into your account. In case you're new, it's time to start your free trial.

2

Prepare a file. Use the Add New button to start a new project. Then, using your device, upload your file to the system by importing it from internal mail, the cloud, or adding its URL.

3

Edit dock receipt form. Rearrange and rotate pages, insert new and alter existing texts, add new objects, and take advantage of other helpful tools. Click Done to apply changes and return to your Dashboard. Go to the Documents tab to access merging, splitting, locking, or unlocking functions.

4

Save your file. Choose it from the list of records. Then, shift the pointer to the right toolbar and select one of the several exporting methods: save it in multiple formats, download it as a PDF, email it, or save it to the cloud.

pdfFiller makes working with documents easier than you could ever imagine. Try it for yourself by creating an account!

How to fill out dock receipt template form

How to fill out a receipt:

01

Gather all necessary information such as the date, time, and location of the transaction.

02

Write down the details of the purchase including the item or service, quantity, and price.

03

Calculate any applicable taxes or discounts and include them in the total amount.

04

Make sure to include your business name, address, and contact information on the receipt.

05

Clearly specify whether the payment was made in cash, credit card, or any other form.

06

Provide a receipt number or reference for easy tracking.

07

Sign and date the receipt to confirm its authenticity.

Who needs a receipt:

01

Customers who want proof of their purchase for warranty, returns, or expense reimbursement purposes.

02

Business owners who need accurate records of their sales, expenses, and tax deductibles.

03

Government agencies or auditors who may require receipts as evidence for financial transactions.

Video instructions and help with filling out and completing dock receipt template

Instructions and Help about what is a dock receipt form

Fill dock instructions undersigned fill : Try Risk Free

People Also Ask about dock receipt template

How do I make a receipt in Word?

How do I create a receipt format?

How do I make a receipt form?

Is there a receipt template in Word?

Is there an app to create a receipt?

How do I fill out a delivery receipt form?

Our user reviews speak for themselves

Read more or give pdfFiller a try to experience the benefits for yourself

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

What is how to ah receipt?

A receipt (sometimes referred to as a bill of sale) is a document issued by a seller to the buyer to acknowledge that the goods or services have been received and paid for. It is usually issued at the time of purchase or shortly afterwards. The receipt should include information such as the date of purchase, the item or items purchased, the total cost of the purchase, and the payment method.

How to fill out how to ah receipt?

1. Start by entering the date of the transaction at the top of the receipt.

2. Enter the name and address of the customer.

3. Enter the description of the goods or services purchased.

4. Enter the quantity and unit price of the goods or services purchased.

5. Calculate the total cost of the items purchased.

6. Enter the payment method used, i.e. cash, credit card, etc.

7. Enter any applicable taxes.

8. Calculate the total amount due.

9. Sign the receipt to confirm the transaction.

What is the penalty for the late filing of how to ah receipt?

There is no specific penalty for the late filing of a receipt. However, failing to keep proper records of business transactions may result in penalties if the IRS audits a business.

What information must be reported on how to ah receipt?

When it comes to reporting information on a receipt, there are several key details that should be included:

1. Name and contact details: The name, address, and contact information of the business or establishment issuing the receipt must be mentioned.

2. Date and time: The exact date and time of the transaction should be clearly stated on the receipt.

3. Transaction details: The receipt should itemize the products or services purchased, along with their quantities, descriptions, and prices. It is important to provide enough detail to clearly identify each item.

4. Payment method: The receipt should specify the method of payment used, whether it's cash, credit card, check, or other forms. If applicable, the last few digits of the credit card number may also be included.

5. Taxes and discounts: Information regarding any applicable taxes, such as sales tax or value-added tax (VAT), should be displayed. Additionally, if any discounts or promotions were applied to the transaction, they should be noted as well.

6. Total amount: The final total amount paid by the customer, inclusive of taxes and any other charges, should be clearly stated.

7. Receipt number: A unique identification number, also known as a receipt number or invoice number, should be assigned to each receipt for tracking and reference purposes.

8. Return policy: If the business has a return or refund policy, it is advisable to include a brief summary or reference to this policy on the receipt.

9. Additional information: Depending on the nature of the business, there may be certain compliance requirements that need to be met, such as product codes, warranties, or legal disclaimers. It is important to include any necessary additional information specific to the business or industry.

It is worth noting that specific requirements for receipts may vary depending on the country, state, or local regulations. Therefore, it is advisable to consult local laws and guidelines to ensure compliance.

How do I modify my dock receipt template in Gmail?

You may use pdfFiller's Gmail add-on to change, fill out, and eSign your dock receipt form as well as other documents directly in your inbox by using the pdfFiller add-on for Gmail. pdfFiller for Gmail may be found on the Google Workspace Marketplace. Use the time you would have spent dealing with your papers and eSignatures for more vital tasks instead.

How can I send how to ah receipt to be eSigned by others?

Once your dock receipt form make is complete, you can securely share it with recipients and gather eSignatures with pdfFiller in just a few clicks. You may transmit a PDF by email, text message, fax, USPS mail, or online notarization directly from your account. Make an account right now and give it a go.

How do I make changes in dock receipt pdf?

The editing procedure is simple with pdfFiller. Open your dock receipt form in the editor. You may also add photos, draw arrows and lines, insert sticky notes and text boxes, and more.

Fill out your dock receipt template form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.

How To Ah Receipt is not the form you're looking for?Search for another form here.

Keywords relevant to dock receipt example form

Related to dock receipt sample

If you believe that this page should be taken down, please follow our DMCA take down process

here

.